Techniques for Locating the best Financial Rates

- Loan-to-worth ratio: An LTV proportion measures up the loan proportions on property’s purchase rate. Basically, a top downpayment usually lower your LTV and relieve the new lender’s chance due to the fact amount http://cashadvanceamerica.net/personal-loans-in/ borrowed is actually faster. This can help you score less interest.

- Mortgage duration: Going for a shorter mortgage term, for example 15 years, reduces the lender’s risk just like the you might be paying off the mortgage more than a great less schedule. There’s reduced exposure which you are able to standard into the financing, so you may found a better rate of interest.

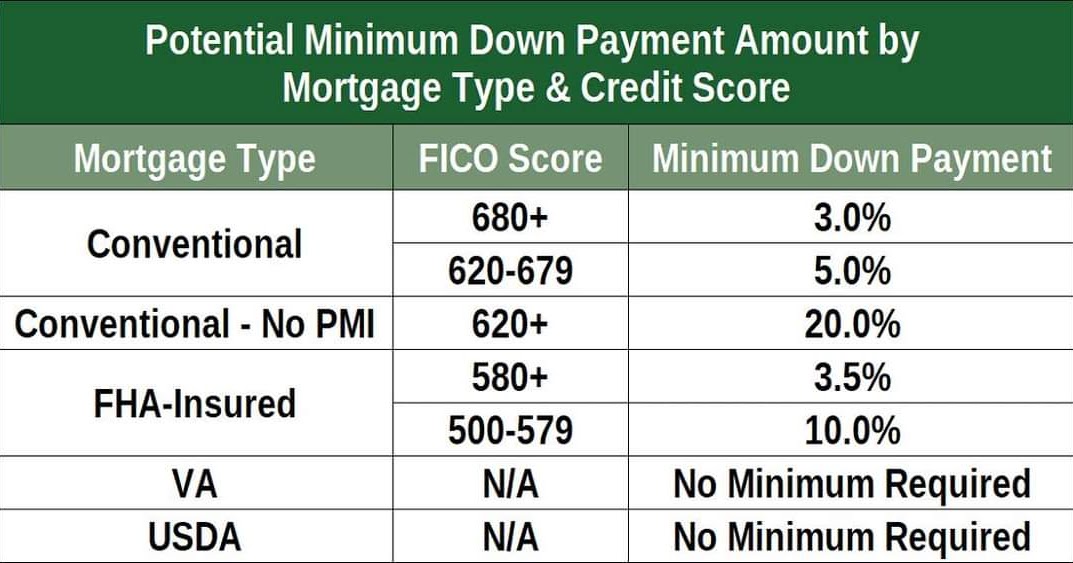

- Mortgage style of: The type of mortgage you decide on may affect the speed you only pay. FHA financing and you may Virtual assistant funds features down mediocre financial costs compared for some old-fashioned mortgage loans.

- Write off circumstances: A discount point, known as a home loan part, try an optional commission you can shell out the financial in return getting less interest. For every area you buy, it is possible to usually pay 1% of one’s residence’s purchase price and lower their price from the up to 0.25%.

Just like any financing, it’s a good idea to search and contrast home loan prices to obtain the better mortgage. Here is how to get it done:

- Look at your credit scores. Lowest credit score criteria are priced between bank in order to financial, however, fundamentally, the reduced their score, the higher your chances of loan acceptance with beneficial terminology. You can access your rating free of charge as a result of Experian, and you will secure free duplicates of the credit report by way of AnnualCreditReport.

- Search your property mortgage choices. As mentioned significantly more than, home loans are present in most size and shapes, together with regulators-recognized, conventional and you will jumbo loans. How would you like an initial- otherwise a lot of time-term loan? Repaired or varying rates? Consider carefully your much time-term needs and exposure tolerance so you’re able to influence an educated kind of loan for your requirements.

- Rating preapproved. A home loan preapproval not just improves your own reputation having family suppliers, in addition, it offers a quick peek within possible mortgage cost you might found. With respect to the lender, you are capable submit the brand new prequalification app plus supporting data online, over the telephone or even in people.

- Shop and you can evaluate costs out of numerous loan providers. An individual Monetary Protection Agency (CFPB) advises taking financing quotes from at least about three lenders. Opinion their also provides, including the interest rate, Apr, fees and you can monthly premiums, so you’re able to pick the best mortgage for the disease.

Alter your likelihood of landing a lower interest rate of the improving your credit rating before you apply. At the same time, making more substantial advance payment, to buy home loan factors and you can choosing a smaller loan title could help you snag a lowered home loan speed.

Vault’s Advice: Mortgage Price Fashion having 2024

Just after an intense years of interest price hikes by the Government Put aside away from , mortgage cost possess cooled a while. Homeowners within the 2024 have experienced cost consist of 6.62% in the first few days out of 2024 to a top away from 7.22% in-may, paying off within six.99% at the start of June.

The commercial and you will Casing Browse Category predicts financial growth to help you sluggish in 2024 and 2025 but will not expect a recession. The group along with predicts one rates walk from the Government Set-aside later on in. Consequently, i anticipate home loan prices to keep raised as a consequence of most of 2024, claims Freddie Mac Captain Economist Sam Khater. [W]e invited property consult to stay higher due to positive class, especially in the fresh beginner house sector.

Look at Newsweek Container on vital mortgage rate facts and methods needed seriously to safe a mortgage towards finest readily available words

However, rates try impractical to go back to their 2020 and you may 2021 downs of about step 3% to three.5%, a dot perhaps the very hopeful economist will not anticipate striking inside the 2024.

コメントを残す