Need to make Irregular Costs? Do you need Heightened Computation Choices?

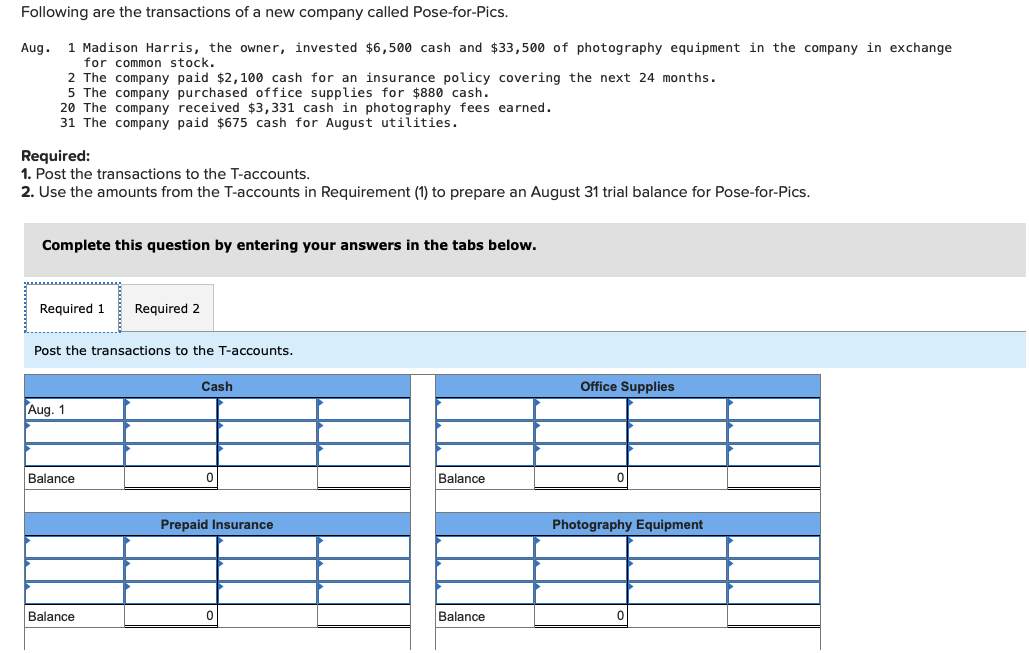

It calculator makes you enter into a primary swelling-share even more percentage as well as additional monthly premiums hence correspond that have the normal monthly premiums. I supply about three other choices you can consider to other a lot more payment problems.

- Biweekly Payment Strategy: Excite discover the bi-each week financial calculator by using biweekly money and come up with an excellent 13th monthly payment.

- Extra Payments In The borrowed funds Identity: For many who begin making extra costs between your financing after that enter the latest mortgage equilibrium when you already been making additional payments and set the mortgage name getting however a lot of time your have left throughout the financing. Such as for instance, whenever you are step three.5 years toward a thirty-12 months mortgage, you’ll lay the borrowed funds identity in order to twenty-six.5 years and you perform lay the loan equilibrium so you can any sort of count is found on your declaration. If you do not has actually an announcement observe the modern harmony you could potentially calculate the modern equilibrium if you see in the event that loan first started, exactly how much the loan are to have & your interest rate.

- Irregular Extra Repayments: If you’d like to create unpredictable extra contributions otherwise efforts and that enjoys an alternate periodicity than your own regular repayments is all of our advanced extra home loan repayments calculator enabling one make multiple concurrent additional payments having varying frequencies along with other lump sum additional money.

For your convenience most recent Los angeles mortgage rates was typed the lower the new calculator to make direct data showing current market standards.

Refi Today & Save: Lock-during the Los Angeles’s Reasonable 31-12 months Mortgage Pricing Now

What kind of cash do you help save? Compare loan providers serving Los angeles for the best mortgage to help you fit your needs & protect reasonable pricing now!

Automatically 29-year repaired-speed finance was shown about desk below. Filters let you alter the amount borrowed, stage, or financing style of.

When you sign up having a 30-seasons financial, you are sure that you’re in they with the future. You may not also think of seeking pay off your home loan early. Whatsoever, what’s the area? Unless you are doubling abreast of your payments monthly, you aren’t going to make a life threatening affect their bottom line – best? Possible nevertheless be repaying the loan for decades – proper?

Never. Also to make quick more costs through the years can also be shave age regarding your loan and you will help save you several thousand dollars in the focus, with regards to the regards to your loan.

Early Mortgage Installment: A little Happens a long way

One of the most prominent ways that somebody spend even more toward its mortgages is always to generate bi-each week mortgage repayments. Payments were created all the 14 days, not simply twice a month, which results in an additional mortgage payment on a yearly basis. You will find twenty six bi-each week episodes in, however, and then make just a few repayments thirty day period carry out end in twenty four repayments.

As opposed to investing twice each week, you can get to the same results by the addition of step one/12th of one’s homeloan payment on payment. Throughout the entire year, there are paid the other times. Doing so can shave four to 8 age off the existence of the loan, together with a great deal of dollars inside interest.

But not, it’s not necessary to pay anywhere near this much while making an effect. Also using $20 or $fifty a lot more monthly can assist you to reduce the financial quicker.

If you have a 30-12 months $250,100 mortgage with a beneficial 5 per cent interest rate, you’ll pay $1, per month in the principal and you may appeal alone. You will spend $233, inside the interest during the period of the loan. For many who spend an extra $50 monthly, you will lay aside $21, from inside the notice along the longevity of the borrowed funds and you may pay-off the loan 24 months and five days prior to when you would possess.

You are able to create you to definitely-go out costs on your dominant together with your annual bonus out of work, income tax refunds, resource dividends or insurance coverage payments. Any additional commission you will be making to your dominating helps you decrease your interest repayments and you will shorten the life span of your mortgage.

Considerations for additional Money

Paying the financial very early actually usually a zero-brainer. Though it will help the majority of people help save thousands of dollars, it is far from usually the easiest way for many individuals adjust the profit.

Compare their prospective deals for the almost every other expenses. Such as for example, if you have credit card debt in the fifteen per cent, it makes even more feel to pay it well just before placing any more money on their home loan who has merely an effective 5 per cent rate of loan in Arvada CO interest.

Contemplate any alternative investment it is possible to make into money that might leave you a top get back. When you can build a great deal more which have an investment and also have an urgent situation offers money booked, you could make a bigger financial effect spending than paying their home loan. Its really worth detailing volatilility ‘s the price of entry to have highest earning advantage kinds for example equities & winnings on equites is taxed that have sometimes quick-label otherwise long-label resource development fees, and so the difficulty speed to have expenditures are definitely the interest rate on your financial while the rates new expenditures try taxed in the.

Investing additional towards your home loan might not add up for those who aren’t likely to remain in your house for more than a great long-time. You simply will not lower your own guarantee quick sufficient to make it well worth it if you’re planning to maneuver inside shorter than simply five to help you ten years. You should also very carefully assess the trend in your local casing field before you pay extra into the the home loan.

Figuring Your Mortgage Overpayment Savings

Need to create your family collateral smaller? Utilize this free calculator to see how actually brief more payments can save you several years of payments and you will several thousand dollars from extra appeal cost. And also make most money early in the mortgage helps you to save much more money along the life of the mortgage due to the fact extinguised dominating no longer is accruing notice for the remainder of the mortgage. The sooner you begin purchasing even more the greater currency you can save.

Use the significantly more than home loan more than-commission calculator to decide their possible deals through extra money into your mortgage. Set up any number that you like, out of $ten to help you $step one,100000, to determine what you can help save along side life of the loan. The outcome can help you consider your financial options to select in the event the settling the financial are certain to get many advantages otherwise if you should focus your efforts with the other funding solutions. Because you nearly done your mortgage repayments early make sure you find out if the loan keeps a beneficial prepayment penalty. If this do, it’s also possible to leave a little harmony until the prepayment penalty period ends.

Home owners May want to Re-finance When you are Rates Try Lowest

The new Government Put aside has hinted he is likely to taper their bond purchasing system afterwards this current year. Lock in the current low cost and you can save very well your loan.

コメントを残す